INCOME

TOOLBOX

STRUCTURED INCOME PLANNING SYSTEM

Sarasota Financial Group are both Registered Representatives and Investment Advisor Representatives with over 40 years of financial industry experience, specializing in Innovative Tax and Structured Income Planning. We generate multiple solutions that will show the impact of income optimization, tax liability, inflation, target changes, and investment strategies, including income riders to show the impact that might have. We can increase your income by calculating the maximum lifetime withdrawals from a simplified uncapped index accumulation annuity. The withdrawal amount can be re-calibrated whenever the contracts restes to ensure you are always enjoying the largest annual income based on your own needs. This strategy has been shown to increase your annual income up to 40%. We then review solutions and then test them for survivorship, lifestyle changes, wealth transfer and inheritance modeling, long term care and other health issues. Identify and address gaps.

SFG Retirement Income Planning Guide

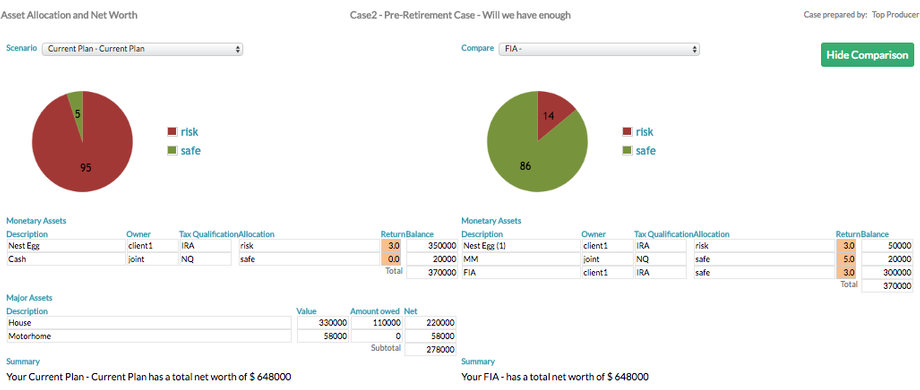

Asset Allocation and Risk Management

Your Structured Income Plan will show your Asset Allocation and Networth in a graphic report. This allows you to easily document your current net worth and financial position as well as their current “risk” profile.

The graphic illustration of safe or conservative options vs options with more risk attached makes these concepts easy for you to understand.

- Help you see and understand your net worth and risk profile based on your current position.

- Compare your current risk profile with a new proposed asset allocation to manage risk aversion.

- Provide graphic demonstration of current and proposed strategy

The Asset Allocation Module allows you to visualize how a different plan can move you to a strategy with less risk and a more secure future financial position.

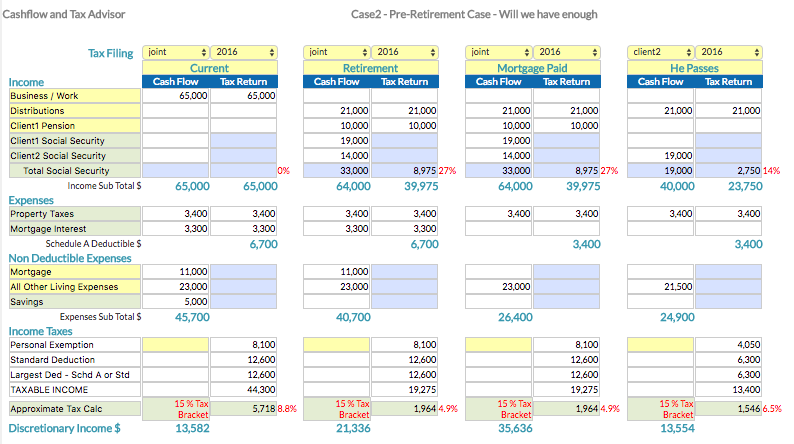

Cash Flow and Taxes

Your Structured Income Plan will itemize all your sources of income, categorized by type, as well as documenting outflows for all expenses. This makes for a clear snapshot of surplus income or indeed shortfalls necessary to maintain ones lifestyle.

- Map your current cash flow, expenses and taxation position.

- Demonstrate multiple scenarios with different financial options along with taxation implications.

- Show possible future changes in your reality and their implications.

- Tax Module immediately calculates approx. tax liability including the impact of a financial strategy on taxes on Social Security income.

- Calculate any potential tax liability based on the relative tax schedule and the sources of income and available deductions.

- Allows you to see the side by side the impact of a new financial strategy on income and tax liability to see the results of a redistribution of your retirement funds.

- Allows you to demonstrate multiple scenarios in a single document. In this case, we are looking at a future financial position if a spouse passes or you pay off the mortgage.

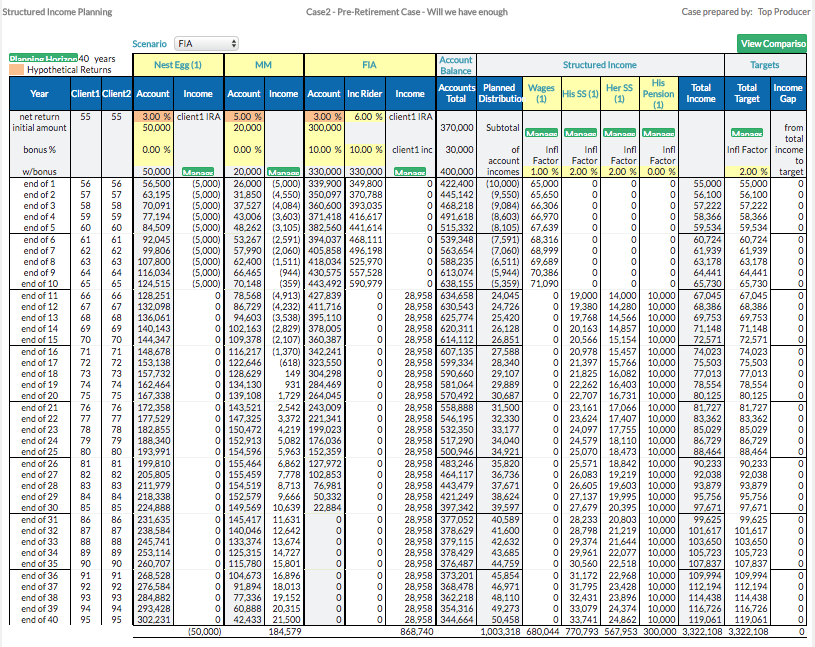

Structured Income Planning

Create an Income Plan for you that is comprehensive, showing all of your accounts and other sources of income in a single page document. It is easy for you to understand your recommendations in a concise clear format.

- Show equity accounts, savings accounts, annuities, and life insurance policies etc.

- Show Social Security, Pensions, Rental Incomes, etc. Other Income can be indexed for inflation or COLA increases.

- Show If you are still working.

- Show earnings expected between now and when you plan to retire.

- Show a target income that you have determined you will need for your retirement. Target Income can be indexed for inflation.

- Show projected plan performance for 16, 24, 32 or 40 years.

- Show income rider annuities.

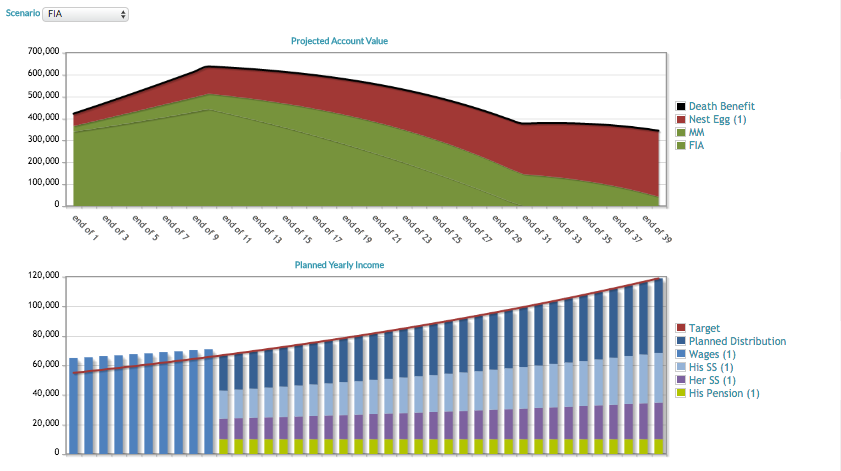

The Income Plan can also be viewed in a graphic format.

SFG Retirement Income Planning Guide

Sample Structured Income Plan

SCHEDULE YOUR OWN

CONFIDENTIAL MEETING