SFG FEDERAL

LTC TOOLBOX

LONG TERM CARE

SFG Federal is contracted with the Government and we pride ourselves on a unique, comprehensive and educational approach to financial planning for federal employees. We specialize in Long-Term Care (LTC) Insurance solutions with over 40 years' experience in the financial services industry.

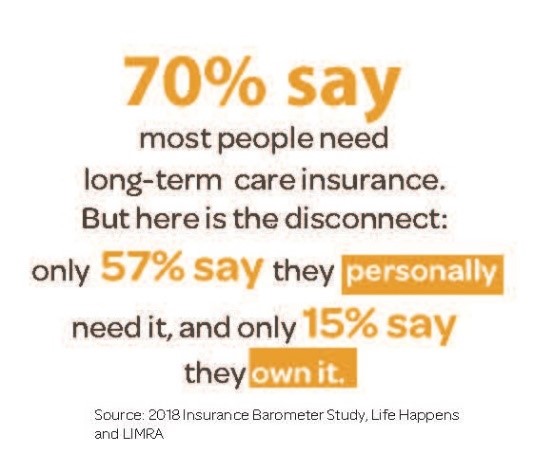

We've solved the biggest risk to your retirement, how to pay for your Long Term Care. There is a 70% chance you will need it and as of right now you have only two choices, self-fund the cost or buy the Federal LTC.

We've solved the biggest risk to your retirement, how to pay for your Long Term Care. There is a 70% chance you will need it and as of right now you have only two choices, self-fund the cost or buy the Federal LTC.

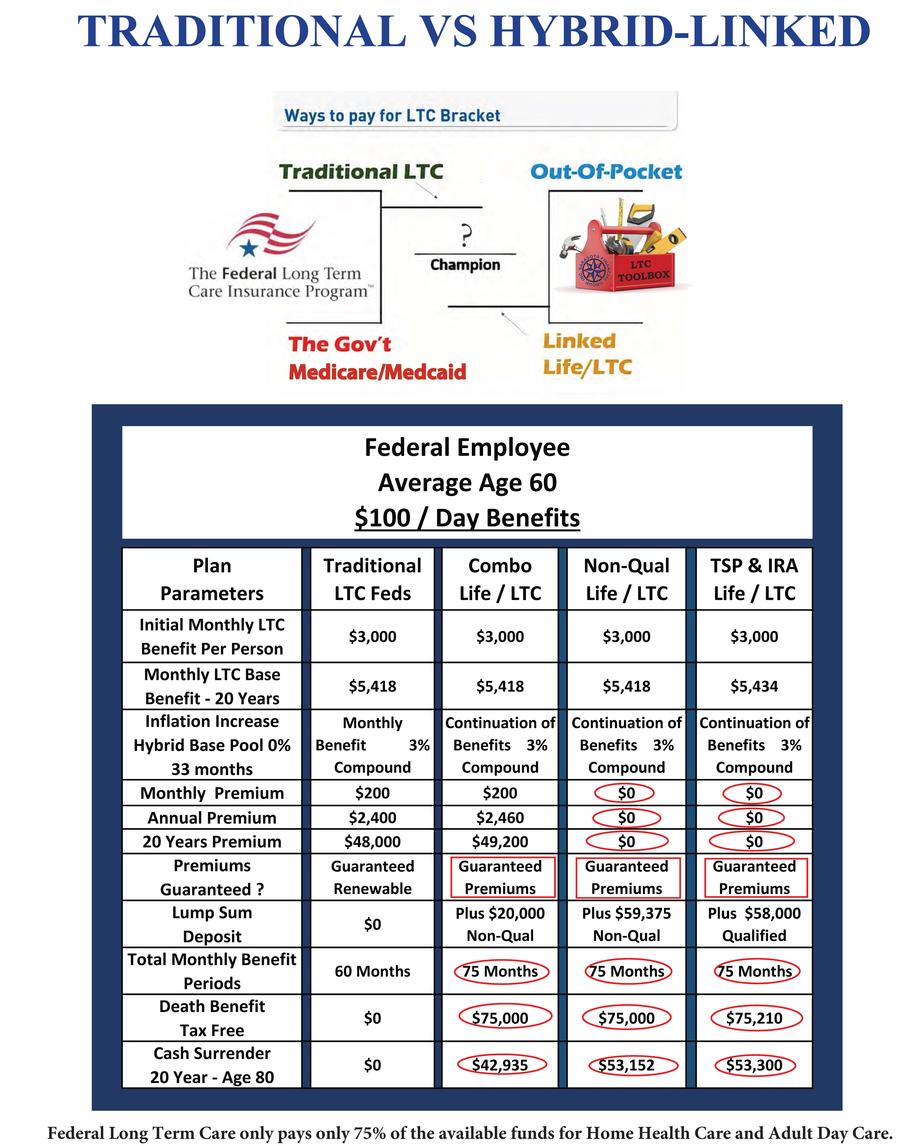

Our LTC Toolbox guide to show you the significant advantages of our Hybrid-Linked plans over the (LTCFeds) Federal Long Term Care Insurance Program.

The

The Office of Personnel Management has no contingency plan for its Federal Long-Term Care Insurance Program (FLTCIP) if the market continues to spin out of control. The long- long term care market has and is changing rapidly, and OPM needs to better prepare for those changes, the agency's inspector general said in a recent report.

Long-term care insurance premiums rose as much as 126 percent the last time OPM re-competed its contract for the program back in 2016. The premium hikes affected roughly 264,000 active and retired federal employees, who are paying an average of $111 more per month for the same they had in previous years. With the current pace of change in the long-term care insurance market, FLTCIP participants could see even higher premiums in the future, the IG said.

Since 2002, John Hancock Life & Health Insurance Company has offered long term care insurance coverage to eligible members of the Federal family. In the past 10 years, they have raised rates for the following Federal Long Term Care Insurance Program (FLTCIP) inforce benefit booklet series:

|

Benefit Booklet Series |

Years Available for Sale |

Year of Increase |

Percentage of Increase |

|

FLTCIP 1.0 |

2002-2009 |

2010 |

A 25% maximum increase was implemented for enrollees with the Automatic Compound Inflation Option (ACIO), whose age at purchase was 69 or younger. |

|

FLTCIP 1.0 |

2002-2009 |

2016 |

An overall average increase of 83% was implemented. The increase varied based on an enrollee's age at the time of enrollment, plan originally purchased, and plan design.

|

Coverage under the FLTCIP is guaranteed renewable, this means FLTCIP coverage cannot be canceled based on a change in an enrollee's health or age. As long as premiums are paid and benefits have not been exhausted, coverage will continue. However, it is important to note that premiums are not guaranteed and may increase in the future if you are among a group of enrollees whose premium is determined to be inadequate.

At SFG Federal, our solutions have the potential to give you lower costs with guaranteed premiums, life time benefits for both spouses, 100% return of premium, and a significant death benefit.

So, if you don't use it for long term care, you don't lose it.

Our mission is simple - we want to make the process of planning for Long-Term Care easy for you.

SFG Federal specializes in offering a distinct services for all Federal Employees in helping them with their retirement preparation:

Federal Employee Benefits

Individual Benefits Analysis

FERS Retirement:

What are my retirement options? Is it true I can get a higher pension if I stay to age 62 with 20 years of service?

Serviceman Group Life Insurance (SGLI) to Veterans Group Life Insurance (VGLI)

Is it true my premiums go up every 5 years once I retire? How can I prevent this and still have coverage?

SCHEDULE YOUR OWN CONFIDENTIAL MEETING

TO RECEIVE YOUR COMPLEMENTARY

FEDERAL BENEFIT ANALYSIS

All individuals in the scenarios presented are fictitious and all numerical examples are hypothetical and are used for analytical purposes only. Provided content is for overview and informational purposes only and is not intended and should not be relied upon as individualized tax, legal, fiduciary, or investment advice. The policies and long-term care insurance riders have exclusions and limitations. For cost and complete details, contact your insurance agent or company.

NOT A DEPOSIT • NOT FDIC OR NCUA INSURED • NOT BANK OR CREDIT UNION GUARANTEED • NOT INSURED BY ANY FEDERAL GOVERNMENT AGENCY • MAY LOSE VALUE

aa

All individu

als in the